May 10, 2024 | Financial

In the mobility world, the popularity of private leasing continues to grow for several reasons. It offers an attractive alternative to traditional car ownership. With Skoda private lease you always drive one of Skoda's latest, reliable and innovative models for a fixed amount per month.

What is Skoda private lease?

With Skoda private lease, you enjoy worry-free access to the latest model and excellent service for a fixed amount per month, over a period of time. This period can vary from 24 months to 60 months. The Skoda remains the property of the leasing company, so you don't have to make a big investment. Therefore, private lease is ideal for driving a brand new Skoda, without the worries of owning a car. These disadvantages are taken care of by the leasing company.

The benefits of Skoda private lease

Instead of putting down a large sum of money to buy a new Škoda, private lease allows you to enjoy a new Skoda at a fixed monthly rate. Furthermore, you have the option to switch back to a new car after the lease period, so you can always enjoy the latest models, safety and technology. You don't have to worry about the car's residual value either, as you simply hand it back. Maintenance, road tax, insurance and roadside assistance are included in the lease contract. So you know where you stand every month and there are never any unexpected costs.

How does Skoda private lease work?

The private lease process works simply and transparently. First, you choose your desired Skoda model and customise the private lease contract as you wish, such as the term and the number of kilometres per year. Then you can select the desired version and put together the car as you wish. Once you have confirmed the request, you will receive an offer that matches your wishes and requirements. If approved, in most cases delivery can be made directly from stock and you can quickly enjoy Skoda private lease.

Why choose Skoda private lease

Skoda private lease is a popular choice for private customers looking for comfortable and affordable motoring. With private lease from Skoda, you drive a brand new car carefree for a fixed monthly fee. You run no risk and don't have to make a big investment. Get into your dream car today with Skoda private lease!

Feb 28, 2024 | Financial

In the search for car insurance, the golden goal for many is clear: get out as cheaply as possible without compromising on essential cover. It sometimes seems like a game of chess where you have to be strategic to protect your king - in this case, your wallet. This article reveals the steps you can take to minimise your premium and still have peace of mind on the road. All to ensure a as cheap car insurance get as much as possible.

1. Choose the Right Coverage:

The foundation of cheap car insurance lies in selecting the right cover. All-risk insurance is like a fully insured trip to Mars: impressive, but perhaps more than you need. Third-party insurance is compulsory and covers damage you cause to others. Depending on the age and value of your car, this may be sufficient. Consider WA+ for a middle ground between basic cover and full protection.

2. Increase your Excess:

Adjusting your deductible is like tuning a fine radio; find the perfect balance between saving on your premium and the amount you are willing to pay yourself in case of a claim. A higher deductible can lower your monthly costs, but make sure you can cough up this amount in case of an emergency.

Adjusting your deductible is like tuning a fine radio; find the perfect balance between saving on your premium and the amount you are willing to pay yourself in case of a claim. A higher deductible can lower your monthly costs, but make sure you can cough up this amount in case of an emergency.

3. Compare and Review Annually:

The car insurance market is like the stock market: fluctuating. What is a good deal today may be a thing of the past tomorrow. Use comparison sites to evaluate the best options every year. Loyalty to insurers is noble, but not always financially prudent.

4. Bundle Insurance:

Sometimes more is less. By taking out multiple insurance policies from the same provider, you may be eligible for a bundle discount. This is similar to ordering a menu instead of eating à la carte; the total package is often cheaper.

5. Limit your Mileage:

Less driving means less risk, and less risk can lead to lower premiums. Some insurers offer specific discounts for drivers who stay under a certain number of miles per year. It is worth considering if you do mainly city driving or have a second car that is used less.

6. Optimise your Car:

Security features and anti-theft systems can lower your premium. Insurers like to see that your car is less at risk of being stolen or involved in an accident. So installing an alarm or an immobiliser can pay double dividends.

7. Work on your Damage-Free Years:

Build a solid reputation as a driver. Claim-free years are rewarded with a discount on your premium. It is the no-claim discount, a reward for not claiming damage. This discount can add up considerably, making it one of the most effective ways to pay less.

Finding cheap car insurance requires a mix of smart choices, strategic planning and reviewing your situation regularly. By applying the above strategies, you can reduce the cost of your car insurance without compromising on the quality of your coverage. Let the hunt for the most economical car insurance begin, armed with knowledge and insight to get the best deal.

Feb 19, 2024 | Financial

Understanding the car or motorbike theory exam can be difficult. To take this important step towards getting your driving licence, you need to learn and practise a lot. In this article, we will share four important tips that can help you pass the exam. Whether you are practising car theory or getting ready for motorbike theory, these tips will undoubtedly come in handy.

Start studying on time

It is essential to start studying car or motorbike theory early. Getting a driving licence is a crucial step, and it requires a thorough knowledge of traffic rules and signs. Start reading traffic theory books and make summaries to better remember the information. Take time to understand the material and repeat it regularly. By starting on time, you will give yourself the best chance of passing the exam.

Make use of online practice materials

Using online practice materials is very useful to test and improve your knowledge of traffic rules. For car theory practice there are many websites and apps you can use. Make it a habit to perform these exercises regularly and try to evaluate yourself. These exercises will not only help you understand the theory better, but also familiarise yourself with the question format and format of the exam. For motorbike theory, it is also important to practise with specific motorcycle-related questions and situations.

Take a theory course

Consider taking a theory course if you need support and advice. These courses are often offered by driving schools and are designed to prepare you for the car or motorbike theory. During the course, you will receive explanations from a qualified instructor and practice questions will be answered. You will also have the opportunity to ask questions and clear up any uncertainties. A theory course can help you understand the material faster and more efficiently and is a good investment in your future driving skills.

Consider taking a theory course if you need support and advice. These courses are often offered by driving schools and are designed to prepare you for the car or motorbike theory. During the course, you will receive explanations from a qualified instructor and practice questions will be answered. You will also have the opportunity to ask questions and clear up any uncertainties. A theory course can help you understand the material faster and more efficiently and is a good investment in your future driving skills.

Stay calm and confident during the exam

Although taking a car or motorbike theory exam can be exciting, it is important to remain calm and confident. Take time to read and understand the questions carefully before choosing an answer. When in doubt, use the technique of eliminating the incorrect answer options. Trust your knowledge and believe in yourself. It is normal to feel some tension, but don't let this hinder you. Staying calm and focused will increase your chances of success.

Jan 31, 2024 | Financial

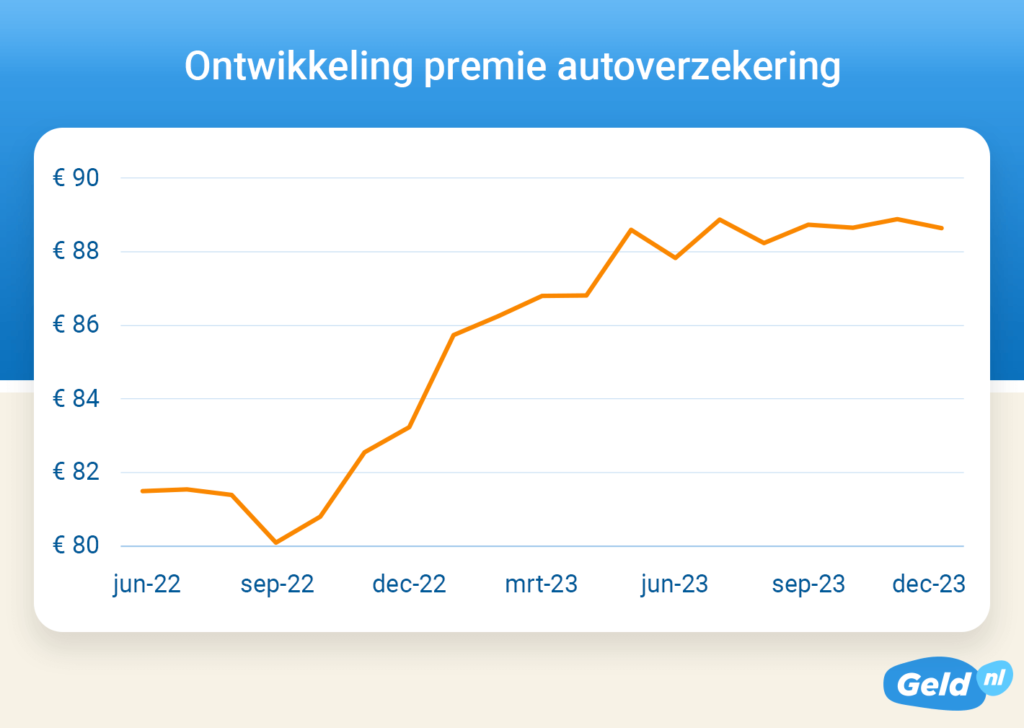

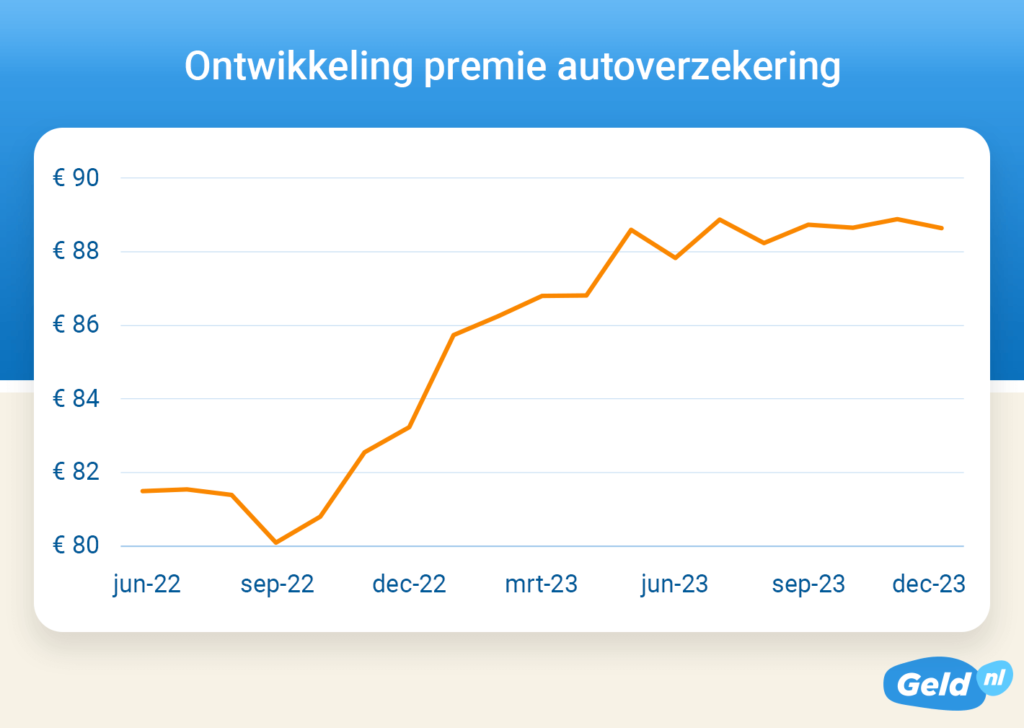

Car insurance policies have become significantly more expensive in the last 18 months. This is according to research by financial comparison site Money.co.uk. In June 2022, the average Dutchman paid over 81 euros per month for his car insurance. That has increased by 9 per cent to almost 89 euros in 2024. This means the average Dutchman will pay 88 euros more on an annual basis in 2024 than a year and a half ago.

Premiums rise due to inflation and high crime rate

"That premiums are rising so fast is mainly due to inflation. In 2022, many products nationwide became more expensive. This applies not only to cars, but also to their repairs. As a result, insurers have to pay more for car damage, resulting in higher premiums," says Amanda Bulthuis, money & insurance expert at Geld.nl.

In addition, rising crime also plays a major role in the increase. For instance, in 2022 and 2023, there were significantly more cars stolen and a relatively high number of car fires. "An increased likelihood of crime is a greater risk for insurers. This leads to you paying more for your car insurance," Bulthuis said. De Nederlandsche Bank's figures show that the claims burden for motor insurers is continuously increasing.

Difference between premiums of car insurers are large

Premiums between car insurers are still high. Research by financial comparison site Geld.nl shows that comparing car insurance can help you find the cheapest car insurance. According to their comparator, the difference between the average and the lowest premium for most motorists is 20 euros per month. That's 240 euros a year! So there is a good chance that you will come out cheaper with another car insurer.

Sep 8, 2023 | Financial |

A business car is a vehicle that can affect the efficiency and appearance of your business. Whether you are just starting out or already quite a ways down the road, a business car can be a good purchase. When looking for a new business car, it is good to consider some things. In this blog, we will give you a hand in choosing your new business car.

Business needs

Before making your choice, it is very important to determine your business needs. What will you use the car for? Will you visit customers a lot, will you mostly transport goods or will you use the car mostly privately as well? How many passengers need to fit in the car and what space do you need? Understanding these factors will ensure you have a clear outline of the kind of car you are looking for.

Consider all options

Besides being able to buy a new car, you have several options. At companies such as Dutchlease you can choose to lease a car. This can be an interesting option. After all, you can choose from a wide range of cars. Don't want to pay too much? A occasion lease business from Dutchlease is also a good option. Here you choose from a range of used cars. This way, you do get to buy a car for your business without incurring too many costs. You can also choose to buy a used car. Do look carefully at the conditions before you buy it.

Budget and costs

Before making a bigger purchase for your business, it is important to look at the financial aspect of your business. Calculate your budget and take into account the purchase and additional costs. Look carefully at what you are looking for and what is within your budget. Also look carefully at maintenance costs. With some cars, parts are scarce, which can make the price skyrocket. If you opt for a business lease car, you do not have to take any repairs or insurance into account.

Sustainability

Sustainability is becoming increasingly important, including in traffic. Therefore, consider choosing a car with low CO2 emissions or opt for a hybrid or fully electric car. Not only will you contribute to a better environment, but you can also benefit from tax advantages and lower costs in the long run. These things also ensure a presentable appearance. This is very important when working with customers. Also, don't forget to take a test drive before buying the car. This way, you can be sure that you have chosen the right car that suits your needs. What will your new business car look like?

Jul 31, 2023 | Financial |

Private lease is a growing trend in the Netherlands, with more and more people choosing to lease their car instead of buying it. There are a number of reasons for this trend, including the fact that private lease can be a more affordable option, especially for people who do not drive many miles.

How does private leasing work?

With private lease, you pay a monthly fee that covers the cost of the car, insurance, maintenance and roadside assistance. The term of the lease is usually between 12 and 60 months, and you can choose a mileage that suits you.

Where to find private lease deals?

There are a several companies that private lease offering deals in the Netherlands. More information on private leasing can be found, for example, on the website of the Consumentenbond for more info on car lease. On this site, we take the Peugeot e-208 as an example.

The Peugeot e-208

One of the most popular cars available on private lease is the Peugeot e-208. The electric Peugeot e-208 is very complete and comes standard in the "Allure Pack" trim which includes climate control, cruise control, 16″ alloy wheels, reversing camera, keyless start, DAB+ radio, LED rear lights, automatic wipers and heated front seats. A navigation system is optionally available. The car's range with a full battery is 362 km, according to the manufacturer.

The cost of private leasing

The cost of private leasing varies depending on the car you choose, the length of the contract and the mileage. However, you can expect to pay between €400 and €500 per month for a Peugeot e-208 depending on which version and conditions you choose. The lease price includes road tax, insurance and breakdown cover, replacement transport in NL after 48 hours, maintenance, tyres and repairs

Statistics

- By 2022, the number of private lease contracts in the Netherlands will have increased by 25%.

- The average monthly cost of private leasing is €450.

- The most popular cars on private lease are the Peugeot e-208, the Renault Zoe and the Volkswagen ID.3.

Conclusion

Private leasing is a great option for people who want to drive a new car without having to worry about the cost of ownership. If you are considering leasing, make sure you compare deals from a number of different companies to find the best deal for you.

Jul 20, 2023 | Financial |

Private lease is a form of car rental where you rent a car for a predetermined period for a fixed monthly fee. With private lease, all costs for the car are included, such as road tax, motor vehicle tax, maintenance, repairs and insurance. So you don't have to save for a down payment or pay for unexpected costs yourself.

Advantages of private leasing

There are many advantages to private leasing. You always have a new car, you don't have to worry about maintenance and repairs, and you know exactly where you stand. Private lease is also a good option for people who don't drive many miles, because you only pay for the kilometres you actually drive.

There are many advantages to private leasing. You always have a new car, you don't have to worry about maintenance and repairs, and you know exactly where you stand. Private lease is also a good option for people who don't drive many miles, because you only pay for the kilometres you actually drive.

Are there any drawbacks?

However, there are also some drawbacks to private leasing. The monthly amount is often higher than the monthly cost of car insurance and maintenance contract. Moreover, you are tied to a certain duration, and if you want to terminate the lease in the interim, you often have to pay a penalty.

How is the monthly amount of private lease determined?

There are a number of factors that determine the monthly amount with private leasing. These factors are:

- The purchase price of the car: The purchase price of the car is the most important factor determining the amount of the monthly amount. The more expensive the car, the higher the monthly amount.

- The term of the lease: The term of the lease contract also affects the monthly amount. The longer the term, the lower the monthly amount.

- Mileage per year: The number of kilometres you drive per year also affects the monthly amount. The more kilometres you drive, the higher the monthly amount.

- Insurance premium: The insurance premium is another factor that determines the monthly amount. The insurance premium depends on the car, the driver's driving experience and where the driver lives.

- Road tax: Road tax is an annual tax you have to pay for using your car. The amount of road tax depends on the car and the province where you live.

- Maintenance and repair costs: Maintenance and repair costs are not included in the monthly amount, but may be a factor when calculating the monthly amount. The amount of maintenance and repair costs depends on the car and the driver's driving habits.

- Fuel costs: Fuel costs are not included in the monthly amount, but may be a factor when calculating the monthly amount. The fuel cost depends on the car, the driver's driving style and fuel prices.

- The down payment: A down payment is not mandatory with private leasing, but it can be a factor in calculating the monthly amount. A down payment reduces the monthly amount, but you have to repay the down payment at the end of the lease contract.

It is important to carefully consider all the factors that determine the amount of the monthly payment before signing a private lease.

What is the difference with financial leasing?

Private lease is different from financial lease. With private lease, you rent the car, while with financial lease, you buy the car. With financial lease, you pay a monthly amount in principal and interest. At the end of the term, you can take over the car, but you can also return it to the leasing company.

Conclusion private lease

In general, private lease is a good option for people who do not want to buy a car, but want to enjoy the benefits of a new car. It is important to carefully compare the pros and cons of private lease with the alternatives, such as buying a car or renting a car.

Are you convinced and want to move forward with private lease then there are several parties who can advise you (online). Here are some tips for choosing a private lease:

- Compare different leasing companies and rates.

- Choose a car that suits your budget and driving habits.

- Make sure the contract is clear and transparent.

- Read the small print carefully.

- Test drive the car before signing a contract.

Jul 14, 2023 | Financial |

Short lease is a form of car leasing distinguished by its flexibility. It allows companies to lease a car for a shorter period of time, without long-term contracts and obligations. Unlike traditional car lease contracts, the term of short lease usually varies between one and 12 months.

The advantages of short lease

One of the main advantages of short lease business is the flexibility it offers businesses. Unlike long-term leases, short lease allows companies to easily respond to changing needs or seasonal demand. This makes it ideal for start-ups or companies that have temporary projects requiring extra cars, for example.

In addition, short lease is also great for companies that need a car quickly. With traditional car leases, it can sometimes take weeks before a car is available. With short lease, on the other hand, a company can have a car within days.

In addition, short lease is also great for companies that need a car quickly. With traditional car leases, it can sometimes take weeks before a car is available. With short lease, on the other hand, a company can have a car within days.

Cost savings

short lease can also bring significant cost savings for companies. Since there are no long-term contracts, companies can easily adjust their fleets according to their current needs. This means there are no unused cars costing money. Moreover, monthly rates for shortlease are often competitive and usually already include the cost of insurance, maintenance and roadside assistance.

No long-term commitments

Another advantage of short lease is that companies are not tied to long-term commitments. This means they are not at financial risk if their needs change or unexpected events occur. Companies can simply terminate the contract whenever they want, without high fines or other penalties. Partly because of this, flex lease an excellent choice!

Short lease or traditional lease?

While both short lease and traditional car leasing offer solutions for business mobility, there are some key differences between the two.

Duration: As mentioned earlier, the term of short lease usually varies between one and 12 months. Traditional car lease contracts, on the other hand, often have a term of two to five years. This makes short lease much more flexible and suitable for companies in need of short-term mobility solutions.

Cost: In traditional car leasing contracts, monthly rates are often based on a fixed amount per month throughout the term of the contract. With short lease, the rates per month can vary depending on the term chosen. This means companies only pay for the period in which they actually use the car, which can be cost-saving.

Maintenance and insurance: With traditional car leases, companies are often responsible for arranging and paying for maintenance and insurance themselves. With short lease, on the other hand, these costs are usually already included in the monthly rate. This provides extra convenience and transparency for companies.

Conclusion

short lease is a flexible and cost-effective solution for business mobility. It allows companies to meet their mobility needs quickly and easily, without long-term commitments.

With the benefits of flexibility, cost savings and convenience over traditional car leases, short lease is an attractive choice for many businesses. Therefore, consider short leasing if you are looking for a flexible mobility solution that can boost your competitiveness.

Jun 15, 2023 | Financial |

Want to lease a car but have no idea how much the monthly lease cost will be? In this article, we look at leasing costs, how you can easily calculate them using a calculation tool and how you can lease financially as an entrepreneur. We also look at the possibility of financial leasing without submitting annual figures.

Calculate lease costs

Do you have your eye on a car you want to lease and are curious about what the monthly costs will be? The following website has a handy lease calculator which helps you calculate monthly costs.

The data you need for the calculation are:

- Purchase value of the car

- Lease amount

- Duration in months

- Value of final instalment

After filling in the details, you can send the application and will receive a quote within one working day.

Financial lease, what exactly is it?

Financial lease, also known as business lease, is a form of financing that allows companies to purchase business assets without direct acquisition costs. With financial lease, the car is financed by a leasing company. The company enters into a lease contract that lays down the terms and the payment structure.

With financial leasing, you become the legal owner of the car during the lease period. You pay monthly lease payments to the leasing company over an agreed period. At the end of the lease period, you can choose to take over the car by making a final payment, which is often a symbolic amount.

With financial leasing, you become the legal owner of the car during the lease period. You pay monthly lease payments to the leasing company over an agreed period. At the end of the lease period, you can choose to take over the car by making a final payment, which is often a symbolic amount.

Some benefits of financial leasing:

- No large initial investment: Financial leasing allows companies to purchase assets without having to pay large sums immediately. This helps companies maintain liquidity and spread costs over a longer period.

- Tax benefits: With financial leasing, the company can often benefit from tax breaks. Lease payments can usually be deducted as business expenses, reducing taxable profits.

- Possibility of financing 100%: In many cases, companies can finance the full purchase value, including VAT, with financial leasing. This means no own contribution is required.

- Flexibility: Financial leasing allows companies to tailor the lease to their specific needs. The lease period can be tailored to the expected lifetime of the asset, and additional options such as maintenance contracts can be included.

- Possibility of ownership: At the end of the lease period, the company usually has the option to take over the asset for a symbolic price. This means the company can eventually become the owner of the asset.

It is important to note that financial leasing also comes with obligations. The company is responsible for maintenance, insurance and any depreciation of the asset during the lease period. It is advisable to read the terms and conditions of the lease contract carefully and, if necessary, seek advice from a financial expert before entering into a financial lease agreement.

Lease without annual figures?

Are you a start-up and do not yet have annual figures but still want to lease? That doesn't have to be a problem!

There is practically no difference between leasing a car without annual figures and financial leasing. The car is used as collateral so providing figures is not necessary. The application for leasing without figures is also virtually the same.

A financial lease without annual figures you can apply for it through the website Autokan, for example. Of course, you do need to be registered with the Chamber of Commerce as a company. Furthermore, there is a limit on the purchase value of the lease car. In the case of a lease without annual figures, this amount may not exceed €50,000.

May 31, 2023 | Financial, Transport and road network |

Recording business car journeys can be a difficult task and may seem daunting for business owners. It is important to accurately track everything from mileage, fuel, maintenance or repairs to other expenses related to using the car on behalf of the business. Keeping accurate records of all these details not only helps businesses manage their budgets effectively, but also provides useful tax records. In this blog post, we will discuss various ways you can record your car journeys so that tracking car expenses is quick and painless!

Using GPS tracking

When you use a company car to travel to different locations, tracking the number of miles you drive can be overwhelming. Fortunately, you can now use a GPS tracker car to help you keep track of this. This technology allows you to track in real-time which route you take and how many kilometres you cover. This allows you to manage travel expenses more efficiently and ensure that costs don't spiral out of control. Using GPS tracking on a company car is an innovative way to accurately manage expenses.

Keeping a logbook

Keeping a logbook in the car's locker can be extremely useful. By writing down each trip and its purpose, you can keep track of exactly what you are doing and why you are doing it. This log can help you make your car trips more efficient and make you more aware of your travel habits. Moreover, a logbook can be useful in case of an accident or insurance claim, as you will know exactly where you have been and why. In short, keeping a logbook can help you manage your car trips better and get a better grip on your driving habits. It is also useful to have as a backup, should GPS tracking or other technology fail.

Keep receipts of expenses

As a company car owner, there are many expenses you have to incur, including fuel and repairs. To keep track of how much money you spend on these expenses, it is a good idea to take photos of receipts. That way, you have a record of all the expenses you incur and can see exactly where your money is going. Moreover, it is handy to have these photos if, for example, you need to inform an insurer about expenses incurred in connection with damage to the car. It only takes a few seconds to take a photo, but it can save you a lot of time and effort in the future.

Installing software

Tracking trips for tax or business purposes is a time-consuming process, but with the right (mobile) software, it can become a lot easier. A good option is FleetGo, which automatically records your trips while you are on the road. This means you no longer have to manually keep track of mileage, and the recorded trips can be easily and accurately exported to a spreadsheet or report. FleetGo is not only useful for individual users, but can also be a valuable tool for companies that manage their fleets and have employees who are regularly on the road.

Feb 22, 2023 | Financial |

As we have also written in other blogs, leasing a car can be a financially sensible choice. Keeping a car on the road is an expensive hobby, especially if you decide to buy one nice car. First of all, you then have to invest a large amount of money in the car of your dreams and then these days you have to pay more and more for fuel and there are several measures coming up that are going to put additional taxes on emissions. A good way to keep the cost of your car under control is to switch to an electric car. Buying an electric car is still on the expensive side but, of course, you don't have to buy an electric car to drive one. How about this? You can also get to private lease going to do. This is an interesting way not only to be able to drive sustainably, but also to make sure that you never face any major unexpected expenses. So this can be financially attractive!

Lease an electric car

At the time of writing, buying an EV is still very expensive. Sure, there are subsidies and pots but still you often have to dig deep into your pockets. This is a reason for many people not to make the switch yet, even though they would like to. In this case private lease electric car from Univé, for example, is an interesting option. This is because you can lease an electric car for a period of five years for a fixed amount per month. You then spread your costs so you don't have to make a big investment all at once. Moreover, you do not have to worry that you will have to bear the costs of any repairs to your car. These are covered by the leasing company. So you have the joys of driving, but not the burdens.

At the time of writing, buying an EV is still very expensive. Sure, there are subsidies and pots but still you often have to dig deep into your pockets. This is a reason for many people not to make the switch yet, even though they would like to. In this case private lease electric car from Univé, for example, is an interesting option. This is because you can lease an electric car for a period of five years for a fixed amount per month. You then spread your costs so you don't have to make a big investment all at once. Moreover, you do not have to worry that you will have to bear the costs of any repairs to your car. These are covered by the leasing company. So you have the joys of driving, but not the burdens.

Which model do you want?

If you are interested in an electric lease car, it is time to see which model you would like. You can choose from many well-known brands including Citroën, BMW, Audi or Tesla. Look carefully at how many kilometres you expect to drive per year. This is important when it comes to the range of your car. This is the number of kilometres a car can cover on a full battery. If you think you will only drive a few hundred kilometres a week, you can choose a car with a lower range. If you spend all day in your car, it is advisable to go for a more luxurious car with a higher range. So be well informed about the car's range to avoid having to recharge your battery every three hours.

Interested in a second chance?

Should you be keen to get a competitive deal, check out the 'second-hand cars' offered by Univé. These are electric used cars that are still in good condition. That way you drive just as well, but for a lower price. Ask Univé about the possibilities.

Dec 22, 2022 | Financial |

You may have noticed that more and more people, both business and personal, are driving electric cars. There are a number of reasons why it is attractive to drive an electric car. One is because electricity costs less as fuel. Another reason that more and more electric cars are being bought and leased is that their range is increasing. There are also many places where electric cars can be charged.

Electric cars are considered a green option. This is also an advantage when you look at the options for leasing an electric car for business purposes. If your business is all about being environmentally friendly, then choosing an electric car is easy!

Which electric lease car do you choose?

Whether you choose a new Peugeot or an electric Hyundai, you are guaranteed to save compared to choosing a traditional petrol car.

Leasing an electric car is also a good idea because these cars cost less when you consider taxes. Electric cars are even partially reimbursed by the government because they do not pollute like petrol cars do.

If you lease an electric company car, the additional tax rate is significantly lower

If you own an electric car and use it for both work and leisure, you will pay much less tax. Even though additional taxes on electric cars have risen in recent years, they are still much lower than taxes on cars that emit pollution. Currently, an electric car costs 13% more than a regular car, and the average additional tax is 22%.

Should you also want to lease an electric car, it is important to do so soon, as various tax breaks are likely to be further phased out in the coming years. Like the subsidy on an electric (private lease) car. Online private lease offer(s) viewing is a good start to taking the plunge into electric driving soon! And to make things even better, the government has also made a new subsidy available. Read all about the SEPP grant.

Dec 18, 2022 | Various, Financial |

In some situations, you need a car or a van, and it should be clear that far from everyone has one in their driveway. Especially in big cities, the percentage of car owners is smaller and many more people use bicycles or public transport.

Fortunately, if you do need a car or van, you can rent one. In every town, there are rental companies you can turn to. Of course, you don't want to pay top dollar for this, so what should you look out for when renting a car or van?

Choose a strategic location

How much you pay for renting a car is determined, among other things, by where you will rent. Are you going to rent a Rent a car in Amsterdam And do you choose a rental company in the middle of the city? Then chances are you will pay more than if you choose a location just outside the city. Of course, this varies per company (and rental chain) but because the rent per m2 in the city centre is higher than for a building just outside the city centre, chances are you will be cheaper outside the city. It is therefore wise to look a little further than the (well-known) landlords in your neighbourhood.

If you are going to rent a car while travelling, then you should note that rental companies at airports are always a lot more expensive. This can sometimes be as much as 20% more expensive than rental companies outside the airport.

If you are going to rent a car while travelling, then you should note that rental companies at airports are always a lot more expensive. This can sometimes be as much as 20% more expensive than rental companies outside the airport.

Choose the right car

Of course, what determines the price even more is which car you choose and what options you choose. The bigger or the fancier the model you choose, the higher the price to rent it. So, do you only need a car to get from A to B and no belongings need to be taken in the car? Then it is wise to choose the smallest car and look for one with as few options as possible.

You often pay a lower amount for this, allowing you to spend the rest of your pennies on something else. Sometimes you can also choose to drive a car with advertising stickers, in which case you pay even less than the regular rental prices. Another great way to save money on renting a car. You can ask about it at the car dealer.

When you need a van

Have you taken on a job on a project basis and really need to drive to the customer with tools? Then it's best to opt for a bus. A van rental in Amsterdam again, you can make it as expensive or cheap as you like.

Insurance and other complementary products

Perhaps needless to say but also look critically at the extra costs such as the additional insurances offered. In many cases, the insurances you already have cover the rental vehicle. Think of your personal car insurance or travel insurance, but sometimes this is already included in the insurance linked to your credit card. So this can also save you a lot on the extra costs when renting a car.

Do you have more tips? If so, be sure to let us know via the comment form!

Oct 21, 2022 | Financial |

When you lease rather than buy a car, the big advantage is that you don't spend a big chunk of money all at once. This is because you pay a fixed amount to the leasing company every month. Would you like to lease a car but is the lease amount for a new lease car on the high side? Then you should look into the possibilities of leasing an occasion car. If you haven't done this before, you might not know how to go about it. Therefore, in this article, we will help you on the right track!

Private lease occasion? Don't take any chances

Have you decided you want to lease a car? Is it your first car? Or is your current car due for replacement? Then you may want to nail it down. It's just not wise to take any chances overnight. As leasing has gained popularity in recent years, the range of options on offer has grown. So you have quite a lot to choose from.

Have you decided you want to lease a car? Is it your first car? Or is your current car due for replacement? Then you may want to nail it down. It's just not wise to take any chances overnight. As leasing has gained popularity in recent years, the range of options on offer has grown. So you have quite a lot to choose from.

Do you see a used lease car and instantly fall in love with it? Then you might want to take out a lease immediately. Yet you would do well to look a bit further. You might find a similar car elsewhere, but for much less money. Therefore, take your time and orient yourself well. Only then will you succeed in getting the best private lease occasion find.

Comparable used lease cars

Anyone looking for a 2nd-hand lease car is likely to start their search online. Chances are you will type something like 'lease used car' into a search engine. This search will give you numerous results. Most people click on one of the first results and see if a suitable used car is among them. If you can't find anything here, you will probably move on to the next site.

When you take this approach, it can take you quite some time to find a used lease car. Fortunately, there is an easier and faster way to compare leased cars. In fact, there are many comparison sites that have already done the work for you. Consider, for example, the company driectleaseprivate.co.uk. After you fill in your requirements, this site will immediately start working for you. You will get an overview in no time, allowing you to quickly see what the best lease car is.

Don't just look at the price

A common mistake when comparing leased cars is that often before the cheapest private lease car is chosen. A low monthly fee is nice, but it should not be at the expense of other things. After all, the terms and conditions are at least as important. If you do not take a look at these before signing the contract, you might end up with surprises. This is not desirable, as it could make your lease contract turn out (a lot) more expensive than you expected in advance. Reason enough to always look beyond the price.

We wish you good luck with the search!

Sep 19, 2022 | Financial |

Did you know that you can also take out a lease as an individual? You don't even definitely have to do this for a brand new car, leasing a used four-wheeler is also possible nowadays! By doing this, you normally have low monthly payments. You also have no initial investment at all, although it is possible to make a down payment so that your monthly costs are reduced by the leasing company. Would you like to lease a used car? If so, it's smart to use the following tips so you don't regret your choice.

Calculate monthly costs

Before you actually sign a leasing contract, you obviously want to know how much you will have to pay monthly. One of the websites you can use to calculate the cost is the site of Private Lease Used. Before calculating this, however, it is wise to set a budget. This will allow you to reject many used leased cars beforehand purely because they are outside your budget. After you have chosen a vehicle, use a car lease calculator so you can calculate what you will actually pay the leasing company each month. Does this fall higher than your budget? Then opt for a lease car that is just a bit cheaper.

Before you actually sign a leasing contract, you obviously want to know how much you will have to pay monthly. One of the websites you can use to calculate the cost is the site of Private Lease Used. Before calculating this, however, it is wise to set a budget. This will allow you to reject many used leased cars beforehand purely because they are outside your budget. After you have chosen a vehicle, use a car lease calculator so you can calculate what you will actually pay the leasing company each month. Does this fall higher than your budget? Then opt for a lease car that is just a bit cheaper.

Watch the mileage

In the case of a leasing used occasion you need to determine several things. These include the used car you want to lease, but also the term and form of the contract. Moreover, you need to include in the lease agreement how many kilometres you will drive the used car annually. This should be seen a bit like a limit. If you drive more than is included in the lease contract, you will probably have to pay extra, so of course you should avoid this. Therefore, think carefully when deciding on the number of kilometres and make sure you have extra space so that you hopefully don't have to pay more to your leasing company.

Look beyond costs

It is only natural that when leasing a used car, you look at the monthly costs in particular. Yet it is wise to look beyond your nose. Many leasing companies will try to tempt you with low monthly costs, but you should not easily fall for that. Instead, it is important to go through the whole agreement; you really need to understand every detail before signing the lease contract. So, for example, also look at the term and what happens if you return the car damaged.

Jun 30, 2022 | Financial |

Administration. Hardly anyone is really fond of it right now. Privately, no, chores involving paperwork we almost all put off as long as possible. This is of course true of administration at work. Generally, we find it a lot of work and we don't see the point of it. You can have a good discussion about the latter.

The amount of time it takes, there's no need to argue about that: yes, it often involves a lot of hours. But did you know that in many cases you can reduce these enormously?

Less work on the fleet

In many companies, the vehicle fleet is something that involves a lot of administration. Whether it be vehicles owned by the company, which are only used during the course of a business, or vehicles that are used for the purpose of business, the

working time is driven, or to lease cars, which go home with employees at the end of the day, extra work in the form of trip recording is (almost) always there.

Much of that work stems from the requirements of the tax authorities. tripregistration. The tax authorities would like to know exactly which journeys are made with a business

car are driven and under what heading these trips fall. Not because they are necessarily so curious, but because they want to know whether the vehicle is also used privately. If that is the case, an additional taxable benefit is calculated on an employee's gross income. If you don't want an additional taxable benefit, you can still drive 500km privately before this takes effect. This is actually a wash, most people do drive 500km privately per month. So then you are bound by the additional taxable benefit.

How does addition work (in brief)

The addition for your lease car is calculated as follows: percentage addition x catalogue value - own contribution (if you have one).

an example:

Your lease car has a purchase value of €30,000, and an additional taxable value of 25%, and you have an own contribution of €1,500 per year.

The taxable addition is then: 25% of €30,000 - €1,500 = €6,000 addition per year.

For the net addition, this amount is multiplied by the applicable income tax rate. For example, if the income tax rate is 37%, then in the above example, the net addition is 37% of €6,000, i.e. €2,220 per year

To know for sure whether a vehicle is being used privately or not, every kilometre driven in it will have to be recorded. Unless it is immediately decided that the

additional taxable income is going to be paid anyway, which can be the case, for example, with lease cars that employees are allowed to use at their own discretion. Trip registration can be quite time-consuming and

But you don't have to! Nowadays, you can also automate it almost completely. A built-in system based on GPS will then take over the mileage registration

and delivers an overview that meets all the requirements of the tax authorities. This will cost both the director and the administration department a lot less time and effort!

What else can be automatic?

No longer having to keep such records manually saves a lot of time and frees up employees to do other things. It inspires

Perhaps we should look further. Are there more things we can do (semi) automatically in the area of administration? Often, yes. What exactly, that is often

Depending on the sector in which a company is active. But the fact is that increasing automation can certainly reduce some of our administration, and we are reaping the rewards.

all the fruits of it.

Adjusting your deductible is like tuning a fine radio; find the perfect balance between saving on your premium and the amount you are willing to pay yourself in case of a claim. A higher deductible can lower your monthly costs, but make sure you can cough up this amount in case of an emergency.

Adjusting your deductible is like tuning a fine radio; find the perfect balance between saving on your premium and the amount you are willing to pay yourself in case of a claim. A higher deductible can lower your monthly costs, but make sure you can cough up this amount in case of an emergency. Consider taking a theory course if you need support and advice. These courses are often offered by driving schools and are designed to prepare you for the car or

Consider taking a theory course if you need support and advice. These courses are often offered by driving schools and are designed to prepare you for the car or

There are many advantages to private leasing. You always have a new car, you don't have to worry about maintenance and repairs, and you know exactly where you stand. Private lease is also a good option for people who don't drive many miles, because you only pay for the kilometres you actually drive.

There are many advantages to private leasing. You always have a new car, you don't have to worry about maintenance and repairs, and you know exactly where you stand. Private lease is also a good option for people who don't drive many miles, because you only pay for the kilometres you actually drive. In addition, short lease is also great for companies that need a car quickly. With traditional car leases, it can sometimes take weeks before a car is available. With short lease, on the other hand, a company can have a car within days.

In addition, short lease is also great for companies that need a car quickly. With traditional car leases, it can sometimes take weeks before a car is available. With short lease, on the other hand, a company can have a car within days. With financial leasing, you become the legal owner of the car during the lease period. You pay monthly lease payments to the leasing company over an agreed period. At the end of the lease period, you can choose to take over the car by making a final payment, which is often a symbolic amount.

With financial leasing, you become the legal owner of the car during the lease period. You pay monthly lease payments to the leasing company over an agreed period. At the end of the lease period, you can choose to take over the car by making a final payment, which is often a symbolic amount.

At the time of writing, buying an EV is still very expensive. Sure, there are subsidies and pots but still you often have to dig deep into your pockets. This is a reason for many people not to make the switch yet, even though they would like to. In this case

At the time of writing, buying an EV is still very expensive. Sure, there are subsidies and pots but still you often have to dig deep into your pockets. This is a reason for many people not to make the switch yet, even though they would like to. In this case  If you are going to rent a car while travelling, then you should note that rental companies at airports are always a lot more expensive. This can sometimes be as much as 20% more expensive than rental companies outside the airport.

If you are going to rent a car while travelling, then you should note that rental companies at airports are always a lot more expensive. This can sometimes be as much as 20% more expensive than rental companies outside the airport. Have you decided you want to lease a car? Is it your first car? Or is your current car due for replacement? Then you may want to nail it down. It's just not wise to take any chances overnight. As leasing has gained popularity in recent years, the range of options on offer has grown. So you have quite a lot to choose from.

Have you decided you want to lease a car? Is it your first car? Or is your current car due for replacement? Then you may want to nail it down. It's just not wise to take any chances overnight. As leasing has gained popularity in recent years, the range of options on offer has grown. So you have quite a lot to choose from. Before you actually sign a leasing contract, you obviously want to know how much you will have to pay monthly. One of the websites you can use to calculate the cost is the site of

Before you actually sign a leasing contract, you obviously want to know how much you will have to pay monthly. One of the websites you can use to calculate the cost is the site of